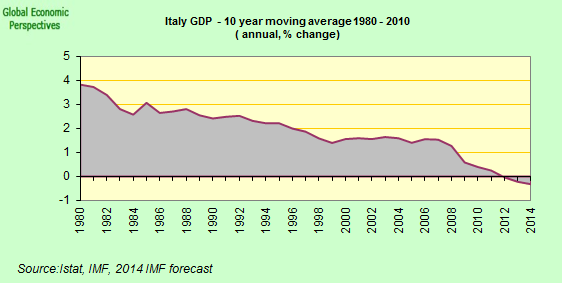

Having started the year in complete chaos with the incompetent and theatrical introduction of the Euro - remember the Foreign Minister had to resign due to lack of support for the currency among his colleagues, Italy's star has not stopped going down. Of course we can all remember the sight of Italy's 'immigration minister' Umberto Bossi threatening to sink a shipload of stateless Kurds in mid-sea. Well in the light of all this the latest news that the Italian economy will only grow by 0.6% this year will perhaps be seen by some as disappointing but for others it is all too predictable. At a time when everyone else is obsessed with deflationary fears, the Italian economy continues to reveal mild inflationary tendencies. This plus a productivity performance below the European average don't add up to anything good. It remains to be seen how this all pans out in time. However if I am only halfway right that demographic factors have an important part to play in the unfolding Japanese story, then, against all expectations, it is to Italy that we should look for the next chapter to be written. Remember this year - despite all promises to the contrary - the Italian public debt as a percentage of GDP will once more start to rise.

Italy's centre-right government on Thursday cut its economic growth forecasts for this year and 2003 but insisted it would respect its European Union commitment to bring the budget close to balance. Giulio Tremonti, finance minister, told parliament that the government was reducing its 2002 growth forecast to 0.6 from 1.3 per cent. Growth next year would be 2.3 rather than 2.9 per cent, he said. Italy's darkening outlook was underlined by a survey which showed consumer confidence falling in September to its lowest level since July 1997. In addition, annual inflation has begun to edge upwards and, according to the harmonised EU index, now stands at 2.6 per cent, compared with a eurozone average of 2.1 per cent.

The government is due in the next 10 days to present its 2003 budget, a document that will indicate how it plans to square its promise of tax cuts for lower-income Italians and no reductions in welfare expenditure with its pledge to the EU to bring down its budget deficit. Mr Tremonti said the government would honour its deficit-cutting pledge. But he said Italy's deficit this year would be just under 2 per cent of gross domestic product, a higher estimate than the 1.1 per cent forecast sent to Brussels this month.

Source: Financial Times

LINK