There are a spate of articles on Romano Prodi's resolutions for 2007 these days in the press. In the first place he is telling Italians in no uncertain terms that where you should look for indulgence is not at the Vatican, but at your local tax office:

In the first 11 months of 2006, income-tax revenue increased more than 9 percent to 33.8 billion euros (44.4 billion). The gains came as Prime Minister Romano Prodi committed more resources to chasing cheaters as part of a pledge to end tax evasion in seven years.

Prodi's effort, which aims to generate 8 billion euros in revenue next year in a country where an estimated 100 billion euros of taxes go unpaid each year, may determine whether Italy is able to fend off fines for breaching the European Union deficit limit. It also contrasts with the policy of former Prime Minister Silvio Berlusconi, who raised revenue through tax amnesties -- forgiving evasion for a fee.

``Eight billion euros in such a short time may seem a little ambitious, but there is no doubt that Prodi's government has taken a stance toward evasion that is very different from the previous one,'' said Annamaria Grimaldi, an economist at Banca Intesa SpA in Milan. ``Not passing amnesties and one-offs all the time is already a step in the right direction.''

Now there are two things to be said here. The first is that this years good returns at the tax offices are largely a product of the exceptionally good year the Italian economy has enjoyed, and of the ongoing process of legalization of immigrants, there is no real evidence of any substantial change in attitudes to paying taxes.

The second thing is, of course, to note that a lot of Italy's immediate economic future hangs on turning dream into reality when it comes to improving tax returns. If not, then the ratings agencies will be once more breathing down the Italian government's necks come the end of next summer.

However even before the money is in and counted (assuming it does in the end arrive, which I think is open to doubt) there are already plans to start spending it:

Italian Prime Minister Romano Prodi, staking his political future on his budget, promises 2007 will be the ``year of the turnaround'' and doesn't rule out cutting income taxes to spur the economy.

``I will insist on growth, without which no other objective can be reached,'' Prodi said at his year-end press conference broadcast by state-owned television Rai SpA.

After winning in April the closest election in Italy's history, Prodi has battled with his allies on how to cure Italy's economic woes and had to resort to confidence votes to get the 2007 budget approved. Faced with a slump in popularity, some members of his nine-party coalition already are clamoring to cut income taxes as soon as next year while Finance Minister Tommaso Padoa-Schioppa says the priority must be to cut debt.

Prodi today tried to dodge the thorny subject. Asked whether his government would use higher tax receipts to reduce income taxes, Prodi said: ``First we need to see how consistent this revenue is and once we have established if it's stable, then the government can decide to cut taxes.''

One way to find the resources to actually cut taxes would be to address the issue of reforming the pensions system. So now attention is focused on accelerating the reform process next year, especially with regard to product market de-regulation, and pension system reform:

Italy’s centre-left government will aim next year to make the economy more competitive by cutting the time needed to start up a company and encouraging foreign investment, Romano Prodi, prime minister, said on Thursday.

Setting out his objectives for 2007, Mr Prodi said he would propose reforms before the end of February to the creaking state pension system, but declared that they would not be so harsh as to justify strikes by those workers affected.

Left-wing critics in Mr Prodi’s nine-party coalition have warned they will resist pension reforms that damage workers’ interests. The premier is constrained to heed their opinion because of the government’s tiny majority in parliament’s upper house.

So here are the promises for 2007, now lets go and see what actually happens, but if I could add, for my taste, Prodi is spending far too much time trying to keep everybody happy, and not enough time taking the difficult decisions which undoubtedly have to be taken to secure Italy's future.

Italy Economy Real Time Data Charts

Edward Hugh is only able to update this blog from time to time, but he does run a lively Twitter account with plenty of Italy related comment. He also maintains a collection of constantly updated Italy economy charts together with short text updates on a Storify dedicated page Italy - Lost in Stagnation?

Thursday, December 28, 2006

Thursday, December 21, 2006

And The Budget IS Passed

I don't suppose this issue had been in doubt in recent weeks, but it is at least one more hurdle over.

Italian Prime Minister Romano Prodi's government survived a confidence vote and passed its first spending package as lawmakers approved plans to cut debt and reduce taxes on low incomes by raising them on higher ones.

The Chamber of Deputies voted by 337 to 262 to pass the budget law. Prodi's government would have collapsed had it lost the ballot because a confidence vote was tied to it.

So now the budget is about to become law. The next step will be to see to extent to which it is effective in achieving its objectives. Standard and Poor's don't seem too convinced:

Standard & Poor's and Fitch Rating cut Italy's creditworthiness on Oct. 19, almost three weeks after the government presented the budget proposal. S&P last week said the budget would fail to cut debt.

The big issue is the extent of dependence on increased taxes and more efficient collection of revenue rather than addressing the structural problems in the spending programme.

Confindustria, perhaps expectedly, are not very convinced either, but I was rather surprised by this:

Italy's largest employers' group, Confindustria, this week said the ``restrictive'' budget would hurt growth next year. Confindustria predicted the economy could grow as little as 1.1 percent after expanding 1.8 percent in 2006. The spending plan will shave 0.3 percentage points from a potential growth of 1.4 percent, the lobby said.

and the following point certainly raised an eyebrow here:

"The deficit may reach 6 percent of GDP this year, up from 4.1 percent in 2005, the government says."

6% of GDP. Well if correct this would certainly explain some of the growth spurt. I haven't seen this number mentioned before, in fact the indications had been the exact opposite, that the deficit would be less than anticipated due to the increased revenue. So is this for real, or is it simply Bloomberg. Anyone out there know?

Italian Prime Minister Romano Prodi's government survived a confidence vote and passed its first spending package as lawmakers approved plans to cut debt and reduce taxes on low incomes by raising them on higher ones.

The Chamber of Deputies voted by 337 to 262 to pass the budget law. Prodi's government would have collapsed had it lost the ballot because a confidence vote was tied to it.

So now the budget is about to become law. The next step will be to see to extent to which it is effective in achieving its objectives. Standard and Poor's don't seem too convinced:

Standard & Poor's and Fitch Rating cut Italy's creditworthiness on Oct. 19, almost three weeks after the government presented the budget proposal. S&P last week said the budget would fail to cut debt.

The big issue is the extent of dependence on increased taxes and more efficient collection of revenue rather than addressing the structural problems in the spending programme.

Confindustria, perhaps expectedly, are not very convinced either, but I was rather surprised by this:

Italy's largest employers' group, Confindustria, this week said the ``restrictive'' budget would hurt growth next year. Confindustria predicted the economy could grow as little as 1.1 percent after expanding 1.8 percent in 2006. The spending plan will shave 0.3 percentage points from a potential growth of 1.4 percent, the lobby said.

and the following point certainly raised an eyebrow here:

"The deficit may reach 6 percent of GDP this year, up from 4.1 percent in 2005, the government says."

6% of GDP. Well if correct this would certainly explain some of the growth spurt. I haven't seen this number mentioned before, in fact the indications had been the exact opposite, that the deficit would be less than anticipated due to the increased revenue. So is this for real, or is it simply Bloomberg. Anyone out there know?

Consumer Confidence Up Again In December

The only think you can say with any degree of certainty about Italian consumer confidence of late, is that it is volatile. In September it was up, in October it was down, in November it was back up again, and now in December it is way up, to the highest reading since 2002:

Italian consumer confidence leaped in December to a 4 1/2-year high as economic growth accelerates.

The Rome-based Isae Institute's index, based on a poll of 2,000 households, rose to 113.6, the highest since June 2002, from a revised 109.3 in November.

So the Italian consumer coming into xmas is feeling good, and this is encouraging news, but we still need to see what sorts of readings we get going into 2007 before we can decide whether this is a real recovery, or an above trend boom. As readers know, I have my doubts.

One factor which undoubtedly has been influencing the high spirits is the recent employment data:

Italy's jobless rate unexpectedly dropped to a 14-year low in the third quarter after companies hired more part-time female staffers and foreign workers were legalized.

The unemployment rate fell to 6.8 percent from a revised 6.9 percent in the second quarter, the Rome-based National Statistics Office said in a statement today.

Of course this is data from the third quarter so there is no necessary match with confidence in December, but it would appear from the confidence level that the positive employment trend continues.

In part the improved employment situation seems to come from more part-time female labour being employed, and in part it seems to come from an inward flow of migrants, with the numbers of migrants being employed rising by 13.6% year-on-year (to a total now of 1.5 million).

But before we all start to cheer too loudly, we should think about this:

"Growth in Italy's $1.8 trillion economy will slow to 1.4 percent in 2007 after expanding 1.7 percent this year, according to the latest forecast on Nov. 6 by the European Commission. This compares with the 2.6 percent growth rate of the thirteen countries sharing the euro, and puts Italy on track to lag its partners for an 11th year in 2007."

So even though growth in Italy has improved markedly this year, it still doesn't seem to have gone above 1.7% and the relative position in growth terms of Italy in the EU seems unchanged.

Italian consumer confidence leaped in December to a 4 1/2-year high as economic growth accelerates.

The Rome-based Isae Institute's index, based on a poll of 2,000 households, rose to 113.6, the highest since June 2002, from a revised 109.3 in November.

So the Italian consumer coming into xmas is feeling good, and this is encouraging news, but we still need to see what sorts of readings we get going into 2007 before we can decide whether this is a real recovery, or an above trend boom. As readers know, I have my doubts.

One factor which undoubtedly has been influencing the high spirits is the recent employment data:

Italy's jobless rate unexpectedly dropped to a 14-year low in the third quarter after companies hired more part-time female staffers and foreign workers were legalized.

The unemployment rate fell to 6.8 percent from a revised 6.9 percent in the second quarter, the Rome-based National Statistics Office said in a statement today.

Of course this is data from the third quarter so there is no necessary match with confidence in December, but it would appear from the confidence level that the positive employment trend continues.

In part the improved employment situation seems to come from more part-time female labour being employed, and in part it seems to come from an inward flow of migrants, with the numbers of migrants being employed rising by 13.6% year-on-year (to a total now of 1.5 million).

But before we all start to cheer too loudly, we should think about this:

"Growth in Italy's $1.8 trillion economy will slow to 1.4 percent in 2007 after expanding 1.7 percent this year, according to the latest forecast on Nov. 6 by the European Commission. This compares with the 2.6 percent growth rate of the thirteen countries sharing the euro, and puts Italy on track to lag its partners for an 11th year in 2007."

So even though growth in Italy has improved markedly this year, it still doesn't seem to have gone above 1.7% and the relative position in growth terms of Italy in the EU seems unchanged.

Tuesday, December 19, 2006

What Are The Christian Democrats Up To?

A couple of weeks ago I had this post on the decision of the Christian Democrats to separate themselves off from the Berlusconi opposition. In the course of that post I suggested:

it is hard to see just how genuine and realistic Casini's initiative is, but if it does move forward it is, of course, just the kind of thing Italy needs. This move would seem to have two consequences.

Firstly Prodi's coalition suddenly becomes more governable, since the majority is now no longer necessarily a wafer-thin one. Also Prodi is now so dependent on the left of his coalition. This may become important as we move into 2007.

Secondly in the longer run this may provoke a 'realignment of the centre'.

Subsequently I have received a couple of interesting mails from Manuel Alvarez-Rivera (who runs the more than useful Election Resources site).

Manuel draws attention to two points of current interest in the Italian political situation:

1/ The Electoral Ballots Recount Issue (see here)

A second partial vote recount was ordered on Thursday amid claims that Italy's hard-fought and extremely close general election last April was marred by vote rigging.

The election committee in the lower house of the Italian parliament decided that all the House votes - blank, contested, spoiled as well as the good ones - should be counted again in 10% of polling stations.

On this Manuel is duly skeptical:

I'm somewhat skeptical as to the fraud claims on account of the significantly lower invalid vote figures, for a couple of reasons.

First, the decrease in the number of invalid votes could be explained by mechanical factors such as a simplified voting procedure, and most importantly political factors. To be specific, given the momentous choice between Berlusconi or Prodi, many Italian voters might have concluded it was no time to waste their votes by spoiling them or casting them blank.

Second, the 2006 invalid poll is by no means unprecedented: in both relative and absolute terms, the figures are almost identical to the corresponding totals for the 1976 election, which was a momentous choice as well, between the Christian Democrats and the Italian Communist Party (PCI). In light of the latter fact, it would seem to me that either those making the fraud claims weren't aware of this, or that they were but decided not to let a pesky fact get in the way of a sensational story.

Incidentally, if last April's Senate election in Italy had been carried out by straight PR (that is, without regional majority prizes), the overall distribution of seats would have been identical to that obtained under Italy's current electoral system. The reason for this is very simple: in eleven of the seventeen regions with PR + majority prize, the winning coalition won by itself more than 55% of the seats, and no majority prize was awarded. Meanwhile, the remaining six regions were evenly split between Berlusconi and Prodi, and as it happened the majority prizes awarded in these (which in all cases amounted to just one or two extra seats per region for the winning group) cancelled each other out. In all, the whole thing turned out to be yet another Berlusconi electoral scheme that didn't quite work out as planned.

Now there's going to be a partial recount for the Chamber election as well.

The center-left - which agreed to the recount - appears wholly unconcerned: they feel (quite correctly in my humble opinion) this is a tempest in a teapot, and that little if any changes in the results are going to come out of it. Not surprisingly, Berlusconi expects the outcome will be overturned, insisting once again he really won the election, Prodi's government is illegitimate and all the usual nonsense.

2/ Political Realignments in Italy

Manuel has this to say:

Concerning political realigments, here's a very interesting link (in Italian).

At any rate, I agree completely with your assessment of the situation. I wouldn't be surprised if the UdC were to find its way into Prodi's government, although it would be a hard sell for the far left, all them more so given the right-wing tendencies of some UdC leaders - such as Rocco Buttiglione. Moreover, right now Prodi can't afford to lose the Refounded Communists in favor of UdC, since such a move could cost the government its fragile Senate majority.

In Italy it is said the Christian Democrats have the uncanny virtue of never being too far from the centers of power, so it will be interesting to see what happens. Incidentally, Mastella and Casini used to be close allies a few years ago, when both led one of the UdC's preceding parties, the CCD.

My gut feeling is that it's no coincidence that the UDC left the House of Freedoms just days after Berlusconi's fainting spell. Casini et al have probably come to the conclusion that the days of Silvio Berlusconi as a major political figure are numbered, and that without him his party (which acts more like a Fininvest company than a real political party) may collapse altogether. Since a good many of Berlusconi's Forza Italia voters are former Christian Democrats, it would make sense that if such an event comes to happen, many Forza Italia's voters would gravitate towards a centrist alliance dominated by (who else?) the Christian Democrats.

it is hard to see just how genuine and realistic Casini's initiative is, but if it does move forward it is, of course, just the kind of thing Italy needs. This move would seem to have two consequences.

Firstly Prodi's coalition suddenly becomes more governable, since the majority is now no longer necessarily a wafer-thin one. Also Prodi is now so dependent on the left of his coalition. This may become important as we move into 2007.

Secondly in the longer run this may provoke a 'realignment of the centre'.

Subsequently I have received a couple of interesting mails from Manuel Alvarez-Rivera (who runs the more than useful Election Resources site).

Manuel draws attention to two points of current interest in the Italian political situation:

1/ The Electoral Ballots Recount Issue (see here)

A second partial vote recount was ordered on Thursday amid claims that Italy's hard-fought and extremely close general election last April was marred by vote rigging.

The election committee in the lower house of the Italian parliament decided that all the House votes - blank, contested, spoiled as well as the good ones - should be counted again in 10% of polling stations.

On this Manuel is duly skeptical:

I'm somewhat skeptical as to the fraud claims on account of the significantly lower invalid vote figures, for a couple of reasons.

First, the decrease in the number of invalid votes could be explained by mechanical factors such as a simplified voting procedure, and most importantly political factors. To be specific, given the momentous choice between Berlusconi or Prodi, many Italian voters might have concluded it was no time to waste their votes by spoiling them or casting them blank.

Second, the 2006 invalid poll is by no means unprecedented: in both relative and absolute terms, the figures are almost identical to the corresponding totals for the 1976 election, which was a momentous choice as well, between the Christian Democrats and the Italian Communist Party (PCI). In light of the latter fact, it would seem to me that either those making the fraud claims weren't aware of this, or that they were but decided not to let a pesky fact get in the way of a sensational story.

Incidentally, if last April's Senate election in Italy had been carried out by straight PR (that is, without regional majority prizes), the overall distribution of seats would have been identical to that obtained under Italy's current electoral system. The reason for this is very simple: in eleven of the seventeen regions with PR + majority prize, the winning coalition won by itself more than 55% of the seats, and no majority prize was awarded. Meanwhile, the remaining six regions were evenly split between Berlusconi and Prodi, and as it happened the majority prizes awarded in these (which in all cases amounted to just one or two extra seats per region for the winning group) cancelled each other out. In all, the whole thing turned out to be yet another Berlusconi electoral scheme that didn't quite work out as planned.

Now there's going to be a partial recount for the Chamber election as well.

The center-left - which agreed to the recount - appears wholly unconcerned: they feel (quite correctly in my humble opinion) this is a tempest in a teapot, and that little if any changes in the results are going to come out of it. Not surprisingly, Berlusconi expects the outcome will be overturned, insisting once again he really won the election, Prodi's government is illegitimate and all the usual nonsense.

2/ Political Realignments in Italy

Manuel has this to say:

Concerning political realigments, here's a very interesting link (in Italian).

At any rate, I agree completely with your assessment of the situation. I wouldn't be surprised if the UdC were to find its way into Prodi's government, although it would be a hard sell for the far left, all them more so given the right-wing tendencies of some UdC leaders - such as Rocco Buttiglione. Moreover, right now Prodi can't afford to lose the Refounded Communists in favor of UdC, since such a move could cost the government its fragile Senate majority.

In Italy it is said the Christian Democrats have the uncanny virtue of never being too far from the centers of power, so it will be interesting to see what happens. Incidentally, Mastella and Casini used to be close allies a few years ago, when both led one of the UdC's preceding parties, the CCD.

My gut feeling is that it's no coincidence that the UDC left the House of Freedoms just days after Berlusconi's fainting spell. Casini et al have probably come to the conclusion that the days of Silvio Berlusconi as a major political figure are numbered, and that without him his party (which acts more like a Fininvest company than a real political party) may collapse altogether. Since a good many of Berlusconi's Forza Italia voters are former Christian Democrats, it would make sense that if such an event comes to happen, many Forza Italia's voters would gravitate towards a centrist alliance dominated by (who else?) the Christian Democrats.

Global Insight's Italy Forecast

Paola sent me the Global Insight forecast for Italy which is worth the read.

The general story is already a reasonably well known one:

Italy’s economy continued to strengthen in the third quarter of 2006, although it was primarily due to a steep inventory build-up, according to a final estimate from the statistics bureau, ISTAT. Real GDP grew by 0.3% quarter-on-quarter (q/q) after having risen 0.6% (upwardly revised from 0.5% q/q) in the second quarter of the year. The economy performed as expected, and thus Global Insight still expects real GDP to grow by 1.7% in 2006, its strongest performance since 2001. The annual comparison was still solid, with real GDP rising by 1.7% year-on-year (y/y), unchanged from the second and first quarters of 2006.

They do however pick up the inventory issue:

The breakdown of GDP by expenditure revealed that solid consumer spending growth and a sharp rise in inventories were the major growth drivers in the third quarter, which offset a large drag from net exports. A marked rise in inventories boosted the overall q/q growth rate by 1.3 percentage points in the third quarter. We believe that the increase in stocks was not deliberate, and was probably the result of lower-than-expected export sales in the third quarter. This could imply a downwards correction in inventory levels in the final quarter of 2006 that would dampen overall economic growth to just 0.1% q/q from the reported 0.3% q/q in the third quarter.

In particular part of the inventory issue obviously exists in the automobile sector, where sales actually declined in the third quarter year on year (even if Fiat did increase its market share):

Retail sales were relatively subdued in the third quarter, while demand for new cars weakened. Indeed, the average level of new registrations contracted by 5.6% y/y in the third quarter, after having climbed 6.8% y/y in the second.

The rise of the euro has clearly been taking its toll:

Net exports weakened significantly, lowering the overall GDP quarterly growth rate by 1.0 percentage point in the third quarter, after making a welcome positive contribution in the first half of 2006. Exports of goods and services contracted 1.7% q/q (but were still up by 3.3% y/y) in the third quarter, after rising very healthily in the first half 2006. The decline in export sales was partly a technical correction after several quarters of strong growth and the result of the steady appreciation of the euro, which has strengthened from an average of US$1.20 in the first quarter to US$1.27 by end-September. A stronger euro hits the Italian export sector hard, making it more difficult to compete with low-cost producers in Eastern Europe and the Far East. Italy specialises in highly price-elastic goods, notably clothing and footwear, as well as capital equipment. In the first half 2006, Italian export sales had been lifted by the relatively healthy global growth and stronger demand across the Eurozone, coupled with the markedly softer euro in the second half of 2005 and the first quarter of 2006. Meanwhile, growth in imports of goods and services strengthened from 0.2% q/q and 3.2% y/y in the second quarter, to 2.1% q/q and 5.4% y/y in the third quarter, reflecting firmer consumer spending.

Strangely there is relatively little discussion in the forecast of the budget deficit situation and the ongoing fiscal tightening that will be required. Juts this bried comment:

The fallout from the 2007 budget process is expected to have a negative impact on both growth and already fragile consumer confidence. The higher tax burden for top income earners and the unpopularity of the 2007 budget will continue to hurt consumer confidence well into 2007. It is likely that some cautious consumers could choose to save rather than spend the additional disposable income as they expect the economy to stumble again, while believing that additional fiscal tightening measures are inevitable.

In contrast the economists over at Global Insight have clearly bought the rise-and- rise euro story, and see this having a much more considerable impact on Italian growth than the fiscal restraint:

Real GDP growth is expected to fall back to 1.3% again in 2007, before accelerating gently to 1.4% in 2008. The slowdown will reflect the prospect of the euro making substantial gains against the U.S. dollar in the vicinity of US$1.40 by the end of 2007 and US$1.48 by end-2008. Consequently, export growth is projected to fall sharply in 2007 and remain subdued in 2008.

Really I think these numbers are way too high, and as we can see the euro is already starting to fall back from the recent highs. Obviously over at Global Insight they would do well to read Claus Vistesen a bit more often. And those who are already reading Claus regularly, might enjoy this post from James Hamilton, who is in many ways saying something similar.

The general story is already a reasonably well known one:

Italy’s economy continued to strengthen in the third quarter of 2006, although it was primarily due to a steep inventory build-up, according to a final estimate from the statistics bureau, ISTAT. Real GDP grew by 0.3% quarter-on-quarter (q/q) after having risen 0.6% (upwardly revised from 0.5% q/q) in the second quarter of the year. The economy performed as expected, and thus Global Insight still expects real GDP to grow by 1.7% in 2006, its strongest performance since 2001. The annual comparison was still solid, with real GDP rising by 1.7% year-on-year (y/y), unchanged from the second and first quarters of 2006.

They do however pick up the inventory issue:

The breakdown of GDP by expenditure revealed that solid consumer spending growth and a sharp rise in inventories were the major growth drivers in the third quarter, which offset a large drag from net exports. A marked rise in inventories boosted the overall q/q growth rate by 1.3 percentage points in the third quarter. We believe that the increase in stocks was not deliberate, and was probably the result of lower-than-expected export sales in the third quarter. This could imply a downwards correction in inventory levels in the final quarter of 2006 that would dampen overall economic growth to just 0.1% q/q from the reported 0.3% q/q in the third quarter.

In particular part of the inventory issue obviously exists in the automobile sector, where sales actually declined in the third quarter year on year (even if Fiat did increase its market share):

Retail sales were relatively subdued in the third quarter, while demand for new cars weakened. Indeed, the average level of new registrations contracted by 5.6% y/y in the third quarter, after having climbed 6.8% y/y in the second.

The rise of the euro has clearly been taking its toll:

Net exports weakened significantly, lowering the overall GDP quarterly growth rate by 1.0 percentage point in the third quarter, after making a welcome positive contribution in the first half of 2006. Exports of goods and services contracted 1.7% q/q (but were still up by 3.3% y/y) in the third quarter, after rising very healthily in the first half 2006. The decline in export sales was partly a technical correction after several quarters of strong growth and the result of the steady appreciation of the euro, which has strengthened from an average of US$1.20 in the first quarter to US$1.27 by end-September. A stronger euro hits the Italian export sector hard, making it more difficult to compete with low-cost producers in Eastern Europe and the Far East. Italy specialises in highly price-elastic goods, notably clothing and footwear, as well as capital equipment. In the first half 2006, Italian export sales had been lifted by the relatively healthy global growth and stronger demand across the Eurozone, coupled with the markedly softer euro in the second half of 2005 and the first quarter of 2006. Meanwhile, growth in imports of goods and services strengthened from 0.2% q/q and 3.2% y/y in the second quarter, to 2.1% q/q and 5.4% y/y in the third quarter, reflecting firmer consumer spending.

Strangely there is relatively little discussion in the forecast of the budget deficit situation and the ongoing fiscal tightening that will be required. Juts this bried comment:

The fallout from the 2007 budget process is expected to have a negative impact on both growth and already fragile consumer confidence. The higher tax burden for top income earners and the unpopularity of the 2007 budget will continue to hurt consumer confidence well into 2007. It is likely that some cautious consumers could choose to save rather than spend the additional disposable income as they expect the economy to stumble again, while believing that additional fiscal tightening measures are inevitable.

In contrast the economists over at Global Insight have clearly bought the rise-and- rise euro story, and see this having a much more considerable impact on Italian growth than the fiscal restraint:

Real GDP growth is expected to fall back to 1.3% again in 2007, before accelerating gently to 1.4% in 2008. The slowdown will reflect the prospect of the euro making substantial gains against the U.S. dollar in the vicinity of US$1.40 by the end of 2007 and US$1.48 by end-2008. Consequently, export growth is projected to fall sharply in 2007 and remain subdued in 2008.

Really I think these numbers are way too high, and as we can see the euro is already starting to fall back from the recent highs. Obviously over at Global Insight they would do well to read Claus Vistesen a bit more often. And those who are already reading Claus regularly, might enjoy this post from James Hamilton, who is in many ways saying something similar.

Sunday, December 17, 2006

Made In Italy At Chinese Prices?

New Economist has a post linking to a recent paper by Francesco Daveri on Italian productivity, and by this somewhat circuitous route (being directed by a comment towards a blog called Business Hackers on my way) I found this article in Spiegel Online about how the arrival of Chinese migrants was changing the face, and economic substructure, of Prato:

Outsiders have long since made their way into Prato....new home to 2,000 Chinese entrepreneurs and an army of low-wage workers, 25,000 strong, which is growing rapidly in front of the walls of this small city of 180,000. One in five of the workers is undocumented and, officially at least, isn't even here. Meanwhile Prato's citizens look on and curse their new neighbors as sewing machines rattle through the night.

Prato's residents call the immigrant neighborhood, which has grown rapidly in the last five or six years in an area once inhabited by local factory workers, "San Pechino," or St. Beijing. When the first Chinese, their suitcases filled with cash, arrived in the early 1990s and leased their factories, the Italians laughed at them. But now that their numbers have quadrupled and they own a quarter of the city's textile businesses, where they make "Made in Italy" fashion at "Made in China" prices -- often illegally -- the newspapers are full of op-ed pieces about the "yellow invasion," low-wage competition and the Chinese mafia. The president of the city's chamber of commerce, who also happens to own a textile business, says: "We underestimated them. What they're doing here is called unfair competition. We need a battalion, an operation like the one in Iraq, to keep them under control."

Prato's residents are now frantically asking themselves questions to which they have no answers. Who are these Chinese? What is their objective?

continue reading Spiegel online

Well placing carefully to one side the paranoia which seems to be revealed by the last sentences, what I find slightly worrying about the situation brought to light in this article is the way some parts of the Italian economy seem to be sliding down the value chain, just as China itself is starting to move up it. Expanding activity in this kind of manufacturing industry is a dubious enough thing to do with global prices as they are in any event, but doing so by allowing the needs of the tax system to support the spending demands of the elderly population to be flouted in just this kind of way is quite another.

There is considerable evidence for the existence of this kind of activity here in Spain too (and I imagine in Greece). But really bringing in undocumented workers to create work which would otherwise be unprofitable (and note that I support inward migration where it has some kind of rationale) seems to be a more or less pointless activity. At best you are renting the land to allow your overseas competitors to get even nearer their market of interest.

In the long run none of this has much future, since as I say, this kind of activity is simply not cost effective in Europe any more, and all it does is create unnecessary resentment among ordinary Italians who cannot understand what the hell is going on.

One example of where all of this can lead is to be found in the Spanish town of Elche (in the Community of Valencia):

The Chinese community in Spain has not yet forgotten the events that took place in Elche, Europe's shoe capital, on September 16, 2004.

That night, a group of Spanish shoemakers set on fire the factories of Chinese entrepreneurs. Local shoe industry workers say the Chinese competitors were playing dirty by offering cheap products distributed in Spain and the rest of Europe but manufactured across the world. Those criticisms, not limited to Spain or the shoe industry, clearly illustrate concerns in Europe with cheap Chinese products.

Now what seems to be happening is that attempts to contain the flow of products by the use of quotas are being got round by renting land and premisses, and importing workers to do the production within the EU. All of this is very difficult to control since, as China Economic Review notes, it is taking place in areas where a blind eye has traditionally been turned to underground economic activity, and it is now virtually impossible to start having an 'eyes wide open' policy overnight, too many other people might be 'found out' at the same time:

Elche, in the east of Spain, is close to Valencia and not far south of Barcelona. It is a city of 200,000 people that has lived for decades on the returns from its shoe industry. For most of this time, it has been known as a place that lives outside labor and tax laws. Employees have often worked illegally without fixed salaries or social security.

Half a century ago, US shoe companies moved their production there, only to transfer it later to markets with even cheaper labor such as India, China and Vietnam.

Invaded by migrants from all over the world (mainly South America, Eastern Europe and Sub-Saharan Africa), European societies are not coping well with change. Europe's economies are struggling to overcome the structural challenges derived from the WTO's Agreement on Textiles and Clothing. In some cases, manufacturers don't even need to move production to China. Chinese workers will work in the heart of Europe for a fraction of the wages European workers demand.

In Elche, Chinese shoemakers have set up warehouses and sell shoes at one tenth the price of locally made products.

Now to be clear, my beef here is not about immigration. My beef is about a degenerate application of public policy and how it always ends up acting against everyone's interests in the long run. We need migrants here to do work with a real economic basis behind it (to meet our man- and woman-power shortages and to help pay our health and pensions system) but, frankly, we don't need this, unless, that is, the respective local councils and governments are willing to pay the retraining costs of these soon to be displaced workers, once the regulations are applied and the no-longer profitable enterprises closed.

Naturally I will post on the somewhat more interesting arguments from Francesco Daveri on Italian productivity (the real variety) under separate cover.

Outsiders have long since made their way into Prato....new home to 2,000 Chinese entrepreneurs and an army of low-wage workers, 25,000 strong, which is growing rapidly in front of the walls of this small city of 180,000. One in five of the workers is undocumented and, officially at least, isn't even here. Meanwhile Prato's citizens look on and curse their new neighbors as sewing machines rattle through the night.

Prato's residents call the immigrant neighborhood, which has grown rapidly in the last five or six years in an area once inhabited by local factory workers, "San Pechino," or St. Beijing. When the first Chinese, their suitcases filled with cash, arrived in the early 1990s and leased their factories, the Italians laughed at them. But now that their numbers have quadrupled and they own a quarter of the city's textile businesses, where they make "Made in Italy" fashion at "Made in China" prices -- often illegally -- the newspapers are full of op-ed pieces about the "yellow invasion," low-wage competition and the Chinese mafia. The president of the city's chamber of commerce, who also happens to own a textile business, says: "We underestimated them. What they're doing here is called unfair competition. We need a battalion, an operation like the one in Iraq, to keep them under control."

Prato's residents are now frantically asking themselves questions to which they have no answers. Who are these Chinese? What is their objective?

continue reading Spiegel online

Well placing carefully to one side the paranoia which seems to be revealed by the last sentences, what I find slightly worrying about the situation brought to light in this article is the way some parts of the Italian economy seem to be sliding down the value chain, just as China itself is starting to move up it. Expanding activity in this kind of manufacturing industry is a dubious enough thing to do with global prices as they are in any event, but doing so by allowing the needs of the tax system to support the spending demands of the elderly population to be flouted in just this kind of way is quite another.

There is considerable evidence for the existence of this kind of activity here in Spain too (and I imagine in Greece). But really bringing in undocumented workers to create work which would otherwise be unprofitable (and note that I support inward migration where it has some kind of rationale) seems to be a more or less pointless activity. At best you are renting the land to allow your overseas competitors to get even nearer their market of interest.

In the long run none of this has much future, since as I say, this kind of activity is simply not cost effective in Europe any more, and all it does is create unnecessary resentment among ordinary Italians who cannot understand what the hell is going on.

One example of where all of this can lead is to be found in the Spanish town of Elche (in the Community of Valencia):

The Chinese community in Spain has not yet forgotten the events that took place in Elche, Europe's shoe capital, on September 16, 2004.

That night, a group of Spanish shoemakers set on fire the factories of Chinese entrepreneurs. Local shoe industry workers say the Chinese competitors were playing dirty by offering cheap products distributed in Spain and the rest of Europe but manufactured across the world. Those criticisms, not limited to Spain or the shoe industry, clearly illustrate concerns in Europe with cheap Chinese products.

Now what seems to be happening is that attempts to contain the flow of products by the use of quotas are being got round by renting land and premisses, and importing workers to do the production within the EU. All of this is very difficult to control since, as China Economic Review notes, it is taking place in areas where a blind eye has traditionally been turned to underground economic activity, and it is now virtually impossible to start having an 'eyes wide open' policy overnight, too many other people might be 'found out' at the same time:

Elche, in the east of Spain, is close to Valencia and not far south of Barcelona. It is a city of 200,000 people that has lived for decades on the returns from its shoe industry. For most of this time, it has been known as a place that lives outside labor and tax laws. Employees have often worked illegally without fixed salaries or social security.

Half a century ago, US shoe companies moved their production there, only to transfer it later to markets with even cheaper labor such as India, China and Vietnam.

Invaded by migrants from all over the world (mainly South America, Eastern Europe and Sub-Saharan Africa), European societies are not coping well with change. Europe's economies are struggling to overcome the structural challenges derived from the WTO's Agreement on Textiles and Clothing. In some cases, manufacturers don't even need to move production to China. Chinese workers will work in the heart of Europe for a fraction of the wages European workers demand.

In Elche, Chinese shoemakers have set up warehouses and sell shoes at one tenth the price of locally made products.

Now to be clear, my beef here is not about immigration. My beef is about a degenerate application of public policy and how it always ends up acting against everyone's interests in the long run. We need migrants here to do work with a real economic basis behind it (to meet our man- and woman-power shortages and to help pay our health and pensions system) but, frankly, we don't need this, unless, that is, the respective local councils and governments are willing to pay the retraining costs of these soon to be displaced workers, once the regulations are applied and the no-longer profitable enterprises closed.

Naturally I will post on the somewhat more interesting arguments from Francesco Daveri on Italian productivity (the real variety) under separate cover.

Tuesday, December 12, 2006

Industrial Production Rebounds in October

Following the 1% decline in September industrial production rebounded in October, and was up 3.7% year on year:

Italian industrial production rose in October for a second month in three on stronger demand for consumer goods such as washing machines and clothing.

Production rose 0.6 percent from September, when it declined 1.0 percent, the national statistics office Istat said today in Rome.

Production of durable goods for consumers rose 1.3 percent in the month, and output of food and beverages jumped 3.5 percent, while clothing production gained 3.7 percent from a month earlier, today's report showed. Production of automobiles gained 15.4 percent in October from a year earlier, Istat said.

But watch out for the future:

The appreciation of the euro may weigh on demand for EU exports in the coming months, slowing growth in 2007. The euro has gained 12 percent against the dollar this year, climbing to $1.3367 on Dec. 4, the highest since March 2005.

Italian industrial production rose in October for a second month in three on stronger demand for consumer goods such as washing machines and clothing.

Production rose 0.6 percent from September, when it declined 1.0 percent, the national statistics office Istat said today in Rome.

Production of durable goods for consumers rose 1.3 percent in the month, and output of food and beverages jumped 3.5 percent, while clothing production gained 3.7 percent from a month earlier, today's report showed. Production of automobiles gained 15.4 percent in October from a year earlier, Istat said.

But watch out for the future:

The appreciation of the euro may weigh on demand for EU exports in the coming months, slowing growth in 2007. The euro has gained 12 percent against the dollar this year, climbing to $1.3367 on Dec. 4, the highest since March 2005.

New Immigration Law In The Works

Just following on from the previous post about the role of immigrants in Italian GDP growth it is interesting to note that Welfare Minister Paolo Ferrero has announced that the government is working on the draft of a new law which would be more coherent with Italy's growing need for and increasing dependence on immigrants:

Italy should have a new immigration law before summer, relaxing restrictions adopted by the previous centre-right government, Welfare Minister Paolo Ferrero said on Thursday.

Speaking after a meeting with local authorities and immigrant associations, he explained that his department, together with the interior ministry, had nearly finished drafting the bill. "The measure should start its passage through parliament in January and be finalized by spring," he said. The law would relax restrictions introduced by the government of former premier Silvio Berlusconi in 2002.

"There are many reasons for changing this old law," said Ferrero. "One of them is the long time it takes to issue residency permits [...] The waiting period can be endless". The 2002 law has also been criticized for the fact that only foreigners with an Italian work contract are allowed a residency permit. Residency permits last just two years and if immigrants lose their job before the expiry date they are required to leave the country.

Ferrero said that one of the most important ideas under consideration was doubling the residency permit's two-year duration. "Part of the idea is to reduce the amount of work involved, which is pointless if the person applying for the permit is legal and has all the necessary prerequisites. "Increasing the length of the permit will reduce the number of requests that need to be dealt with".

Other legislative changes under discussion include the introduction of a single asylum law and a points-based entry system to encourage managed migration. Proposals are also being drawn up to grant certain immigrants the vote and make it easier for them to gain Italian citizenship. Meanwhile another major change, involving the way residency permits are issued, is in the process of being implemented. This transfers authority to grant residency permits from the hands of the police to the control of local municipal authorities.

Italy should have a new immigration law before summer, relaxing restrictions adopted by the previous centre-right government, Welfare Minister Paolo Ferrero said on Thursday.

Speaking after a meeting with local authorities and immigrant associations, he explained that his department, together with the interior ministry, had nearly finished drafting the bill. "The measure should start its passage through parliament in January and be finalized by spring," he said. The law would relax restrictions introduced by the government of former premier Silvio Berlusconi in 2002.

"There are many reasons for changing this old law," said Ferrero. "One of them is the long time it takes to issue residency permits [...] The waiting period can be endless". The 2002 law has also been criticized for the fact that only foreigners with an Italian work contract are allowed a residency permit. Residency permits last just two years and if immigrants lose their job before the expiry date they are required to leave the country.

Ferrero said that one of the most important ideas under consideration was doubling the residency permit's two-year duration. "Part of the idea is to reduce the amount of work involved, which is pointless if the person applying for the permit is legal and has all the necessary prerequisites. "Increasing the length of the permit will reduce the number of requests that need to be dealt with".

Other legislative changes under discussion include the introduction of a single asylum law and a points-based entry system to encourage managed migration. Proposals are also being drawn up to grant certain immigrants the vote and make it easier for them to gain Italian citizenship. Meanwhile another major change, involving the way residency permits are issued, is in the process of being implemented. This transfers authority to grant residency permits from the hands of the police to the control of local municipal authorities.

Immigrants and Italian GDP Growth

Looking for something else I just stumbled across this:

Italy’s 3.6 foreign residents are an added asset to the country’s economy and their labours account for 6.1% of its GDP, some 86.7 billion euros in 2005, according to a new report.

Published Monday in the authoritative financial daily Il Sole 24 Ore, the report pointed out how Italy’s immigrants were responsible for “keeping the nation from suffering two heavy recessions in recent years”.

Without their contribution, Il Sole explained, “Italy’s GDP would have fallen by 0.1% in 2002, 0.6% in 2003 and 0.9% in 2005.

Almost 2.1 million immigrants hold regular jobs and they totally dominate the domestic services sector, accounting for 80% of the sector’s contribution to the country’s GDP to the tune of 9.6 billion euros.

Immigrants play an even bigger role in the services sector contributing 37 billion euros to the nation’s wealth, equal to 4.3% of the sector’s GDP.

According to the report, the contribution immigrants make to the economy has been growing constantly.

From 1993 to 2000, GDP rose 15.4% in real terms, but this would have been 13.5% without immigrants, Il Sole calculated.

In the following five years, GDP rose by 3.2% “of which 3.1% was thanks to the work of immigrants. This is equal to 96% of the increase,” the study concluded.

The data presented here is fascinating. The picture is pretty similar in Spain, although since Spain's population ex-immigration isn't actually falling all we can say is that Spain's economy has risen substantially more than it would. Any Il Sole reader (Paris??) out there know what the actually study they are referring to was, and where it is to be found?

I suppose I don't need to ram this point home, but it does rather confirm my argument that those countries with ageing populations who cannot attract immigrants will actually see GDP shrink at some stage.

Italy’s 3.6 foreign residents are an added asset to the country’s economy and their labours account for 6.1% of its GDP, some 86.7 billion euros in 2005, according to a new report.

Published Monday in the authoritative financial daily Il Sole 24 Ore, the report pointed out how Italy’s immigrants were responsible for “keeping the nation from suffering two heavy recessions in recent years”.

Without their contribution, Il Sole explained, “Italy’s GDP would have fallen by 0.1% in 2002, 0.6% in 2003 and 0.9% in 2005.

Almost 2.1 million immigrants hold regular jobs and they totally dominate the domestic services sector, accounting for 80% of the sector’s contribution to the country’s GDP to the tune of 9.6 billion euros.

Immigrants play an even bigger role in the services sector contributing 37 billion euros to the nation’s wealth, equal to 4.3% of the sector’s GDP.

According to the report, the contribution immigrants make to the economy has been growing constantly.

From 1993 to 2000, GDP rose 15.4% in real terms, but this would have been 13.5% without immigrants, Il Sole calculated.

In the following five years, GDP rose by 3.2% “of which 3.1% was thanks to the work of immigrants. This is equal to 96% of the increase,” the study concluded.

The data presented here is fascinating. The picture is pretty similar in Spain, although since Spain's population ex-immigration isn't actually falling all we can say is that Spain's economy has risen substantially more than it would. Any Il Sole reader (Paris??) out there know what the actually study they are referring to was, and where it is to be found?

I suppose I don't need to ram this point home, but it does rather confirm my argument that those countries with ageing populations who cannot attract immigrants will actually see GDP shrink at some stage.

Wednesday, December 06, 2006

November Retail Sales Don't Look Good

Despite the fact that the November retail sales data across the euro region is quite positive, sales in Italy declined when compared with October:

Italian retail sales fell for the second month in November as the government's plan to raise income taxes curtailed spending.

An index of retail sales stood at a seasonally adjusted 48.0 compared with 47.4 in October, according to a survey of 440 retailing executives compiled for Bloomberg LP by NTC Economics Ltd.

Remember that on all these indexes any reading below 50 signals a contraction.

Italian consumers are facing a double whammy as the ECB raises rates at the same time as the government is set to considerably raise taxes (rather than cut spending) to address the deficit problem. Thus Bloomberg:

The higher taxes are hitting Italian consumers at a time that interest rates are also rising, making consumer loans and mortgages more costly.

As they suggest this contrasts with the eurozone sales data:

The drop in retail sales in Italy contrasts with increases in Germany and France. Sales in both those countries rose, lifting the European index to a record high.

Retail-sales growth accelerated in the euro region for a third month in November, giving the European Central Bank more scope to raise interest rates next year, the Bloomberg purchasing managers index showed.

An index of retail sales in the economy of the dozen nations sharing the euro rose to a seasonally adjusted 53.7, the highest in four months, from 52.8 in October, a survey of more than 1,000 retail executives compiled for Bloomberg LP by NTC Economics Ltd. showed today.

Of course rising interest rates also mean a rising euro, and this will also have an impact on Italian exports, although the extent of this impact still remains to be seen.

Paris is looking on the bright side of things, and points us to the latest data on public finances. There is no doubt that 2006 has been an exceptionally good year by Italian standards, but can we be so optimistic for 2007?

Negli ultimi documenti governativi di politica economica - la Relazione previsionale e programmatica per il 2007 con l'annessa Nota di aggiornamento al Dpef - il deficit pubblico stimato per il 2006, al netto dei debiti pregressi legati ai rimborsi Iva sulle autovetture e alla Tav/Ferrovie, si ferma al 3,6% del Pil, rispetto al 4,0% indicato nel Dpef 2007-2011 presentato in luglio e al 4,1% realizzato nel 2005

However if we look at the details we find:

Il miglioramento dei conti proviene quasi tutto dal lato delle entrate tributarie; il gettito fiscale è aumentato, infatti, nel corso di quest'anno in misura ben superiore alle stime iniziali. Nella Relazione trimestrale di cassa di aprile, ultimo atto ufficiale del governo uscente, le entrate tributarie totali erano calcolate in 407 miliardi di euro. Tre mesi dopo, il Dpef alzava la stima a 417 miliardi, che il recente aggiornamento ha portato a 435 miliardi.

A large part of this has undoubtedly come from the exceptionally high growth (again in Italian terms) seen in 2006 (a year which has, after all, broken all global records). If this expansion in receipts is not maintained in 2007, however, the position may once more deteriorate, so there is really no room for complacency here.

Italian retail sales fell for the second month in November as the government's plan to raise income taxes curtailed spending.

An index of retail sales stood at a seasonally adjusted 48.0 compared with 47.4 in October, according to a survey of 440 retailing executives compiled for Bloomberg LP by NTC Economics Ltd.

Remember that on all these indexes any reading below 50 signals a contraction.

Italian consumers are facing a double whammy as the ECB raises rates at the same time as the government is set to considerably raise taxes (rather than cut spending) to address the deficit problem. Thus Bloomberg:

The higher taxes are hitting Italian consumers at a time that interest rates are also rising, making consumer loans and mortgages more costly.

As they suggest this contrasts with the eurozone sales data:

The drop in retail sales in Italy contrasts with increases in Germany and France. Sales in both those countries rose, lifting the European index to a record high.

Retail-sales growth accelerated in the euro region for a third month in November, giving the European Central Bank more scope to raise interest rates next year, the Bloomberg purchasing managers index showed.

An index of retail sales in the economy of the dozen nations sharing the euro rose to a seasonally adjusted 53.7, the highest in four months, from 52.8 in October, a survey of more than 1,000 retail executives compiled for Bloomberg LP by NTC Economics Ltd. showed today.

Of course rising interest rates also mean a rising euro, and this will also have an impact on Italian exports, although the extent of this impact still remains to be seen.

Paris is looking on the bright side of things, and points us to the latest data on public finances. There is no doubt that 2006 has been an exceptionally good year by Italian standards, but can we be so optimistic for 2007?

Negli ultimi documenti governativi di politica economica - la Relazione previsionale e programmatica per il 2007 con l'annessa Nota di aggiornamento al Dpef - il deficit pubblico stimato per il 2006, al netto dei debiti pregressi legati ai rimborsi Iva sulle autovetture e alla Tav/Ferrovie, si ferma al 3,6% del Pil, rispetto al 4,0% indicato nel Dpef 2007-2011 presentato in luglio e al 4,1% realizzato nel 2005

However if we look at the details we find:

Il miglioramento dei conti proviene quasi tutto dal lato delle entrate tributarie; il gettito fiscale è aumentato, infatti, nel corso di quest'anno in misura ben superiore alle stime iniziali. Nella Relazione trimestrale di cassa di aprile, ultimo atto ufficiale del governo uscente, le entrate tributarie totali erano calcolate in 407 miliardi di euro. Tre mesi dopo, il Dpef alzava la stima a 417 miliardi, che il recente aggiornamento ha portato a 435 miliardi.

A large part of this has undoubtedly come from the exceptionally high growth (again in Italian terms) seen in 2006 (a year which has, after all, broken all global records). If this expansion in receipts is not maintained in 2007, however, the position may once more deteriorate, so there is really no room for complacency here.

Christian Democrats Leave Berlusconi

Now this is interesting news:

The lines of political battle were redrawn in Italy on Tuesday after a prominent opposition politician withdrew his party from the centre-right coalition led by Silvio Berlusconi, the former premier.

Pier Ferdinando Casini, the most powerful figure in the centrist Christian Democratic party (UDC), said Mr Berlusconi’s House of Freedoms coalition, which ruled Italy for five years until last April’s general election, had no future. Mr Casini, 51, is a former speaker of parliament’s lower house whose ambition is to create a “new centre” in Italian politics that would bring together moderate reformist forces from right and left and give Italy more stable governments.

From this distance it is hard to see just how genuine and realistic Casini's initiative is, but if it does move forward it is, of course, just the kind of thing Italy needs. This move would seem to have two consequences.

Firstly Prodi's coalition suddenly becomes more governable, since the majority is now no longer necessarily a wafer-thin one. Also Prodi is now so dependent on the left of his coalition. This may become important as we move into 2007.

Secondly in the longer run this may provoke a 'realignment of the centre'. The first whiff of this can already be seen:

At least one party leader in Mr Prodi’s centre-left coalition has already welcomed Mr Casini’s action. Clemente Mastella, justice minister, who has often argued in favour of a “new centre”, said his Popular-Udeur party and the UDC should form a pact and fight side by side in the European Parliament elections of 2009.

The lines of political battle were redrawn in Italy on Tuesday after a prominent opposition politician withdrew his party from the centre-right coalition led by Silvio Berlusconi, the former premier.

Pier Ferdinando Casini, the most powerful figure in the centrist Christian Democratic party (UDC), said Mr Berlusconi’s House of Freedoms coalition, which ruled Italy for five years until last April’s general election, had no future. Mr Casini, 51, is a former speaker of parliament’s lower house whose ambition is to create a “new centre” in Italian politics that would bring together moderate reformist forces from right and left and give Italy more stable governments.

From this distance it is hard to see just how genuine and realistic Casini's initiative is, but if it does move forward it is, of course, just the kind of thing Italy needs. This move would seem to have two consequences.

Firstly Prodi's coalition suddenly becomes more governable, since the majority is now no longer necessarily a wafer-thin one. Also Prodi is now so dependent on the left of his coalition. This may become important as we move into 2007.

Secondly in the longer run this may provoke a 'realignment of the centre'. The first whiff of this can already be seen:

At least one party leader in Mr Prodi’s centre-left coalition has already welcomed Mr Casini’s action. Clemente Mastella, justice minister, who has often argued in favour of a “new centre”, said his Popular-Udeur party and the UDC should form a pact and fight side by side in the European Parliament elections of 2009.

Tuesday, December 05, 2006

EU Services Continue To Expand

Latest data across the EU suggest that the services sector is expanding at a slightly more rapid pace:

Growth in European services industries, the biggest part of the economy, unexpectedly accelerated in November, prompting speculation the European Central Bank will keep raising interest rates next year.

Royal Bank of Scotland Group Plc said today its services index, which accounts for about a third of the economy and covers industries such as telecommunications and banking, rose to 57.6, a four-month high, from 56.5 in October.

Of course the composite figure hides a fair degree of country level difference. French services, for example, continued to expand, but at a slighly slower rate, whilst the rate of expansion in Italy accelerated:

Doppia sorpresa positiva dal Pmi servizi. L’indice elaborato da Rbs/Ntc intervistando i direttori agli acquisti delle imprese del settore, è salito novembre sia in Eurolandia che in Italia oltre le attese del mercato.

Nella zona euro, l’indice è passato a 57,6 a novembre dai 56,5 di ottobre, raggiungendo il livello più alto da luglio. Anche in Italia l'indice, predisposto da Rbs/Adaci, ha accelerato passando da 54,1 a 56,2, livello massimo da agosto, superando le attese degli economisti (54) e restando saldamento sopra la soglia dei 50 punti che separa contrazione da espansione. Bene anche il dato tedesco che è cresciuto da 54 a 56,8 mentre in Francia è sceso da 61 a 58,8.

Thanks to Paris for the link.

(Any reading above 50 on these indexes constitutes expansion).

Growth in European services industries, the biggest part of the economy, unexpectedly accelerated in November, prompting speculation the European Central Bank will keep raising interest rates next year.

Royal Bank of Scotland Group Plc said today its services index, which accounts for about a third of the economy and covers industries such as telecommunications and banking, rose to 57.6, a four-month high, from 56.5 in October.

Of course the composite figure hides a fair degree of country level difference. French services, for example, continued to expand, but at a slighly slower rate, whilst the rate of expansion in Italy accelerated:

Doppia sorpresa positiva dal Pmi servizi. L’indice elaborato da Rbs/Ntc intervistando i direttori agli acquisti delle imprese del settore, è salito novembre sia in Eurolandia che in Italia oltre le attese del mercato.

Nella zona euro, l’indice è passato a 57,6 a novembre dai 56,5 di ottobre, raggiungendo il livello più alto da luglio. Anche in Italia l'indice, predisposto da Rbs/Adaci, ha accelerato passando da 54,1 a 56,2, livello massimo da agosto, superando le attese degli economisti (54) e restando saldamento sopra la soglia dei 50 punti che separa contrazione da espansione. Bene anche il dato tedesco che è cresciuto da 54 a 56,8 mentre in Francia è sceso da 61 a 58,8.

Thanks to Paris for the link.

(Any reading above 50 on these indexes constitutes expansion).

Tuesday, November 28, 2006

Padoa-Schioppa Ups The Growth Forecast

Finance Minister Tommaso Padoa-Schioppa has just forecast 2% growth for the whole year 2006. After a slowdown to 0.3% in the third quarter (which may, of course, be about to be revised upwards) it seems he is expecting some real heavy lifting in the fourth quarter. We will see.

``The economy is recovering,'' Padoa-Schioppa told reporters after a meeting of euro-region finance ministers in Brussels. ``The problem is for that to turn into growth. That is something that lasts for years and not something that lasts just one economic trend.'' Padoa-Schioppa forecast growth to near 2 percent in 2006.

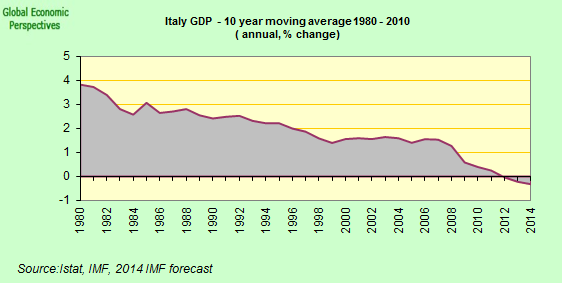

Italy's latest growth forecast had indicated the $1.8 trillion economy would expand 1.6 percent this year and 1.3 percent in 2007. Italy has lagged behind the average growth of its euro region partners for more than a decade and will continue to do so through 2008, according to the European Commission.

``The economy is recovering,'' Padoa-Schioppa told reporters after a meeting of euro-region finance ministers in Brussels. ``The problem is for that to turn into growth. That is something that lasts for years and not something that lasts just one economic trend.'' Padoa-Schioppa forecast growth to near 2 percent in 2006.

Italy's latest growth forecast had indicated the $1.8 trillion economy would expand 1.6 percent this year and 1.3 percent in 2007. Italy has lagged behind the average growth of its euro region partners for more than a decade and will continue to do so through 2008, according to the European Commission.

OECD Forecast Italy To Miss Deficit Target in 2007

In many ways this news is not exactly surprising, given the debate which has already taken place on the topic. The important question is likely to be, if the OECD are proved right, what will be the response from Moody's, Standard and Poor's and the other sovereign debt ratings agencies? The OECD take the view that:

Italy will fail to bring its budget deficit below the European Union ceiling for the fifth consecutive year in 2007, the Organization for Economic Cooperation and Development said.

Italy's deficit will reach 3.2 percent next year, the Paris-based organization said in its twice-yearly forecast. Prime Minister Romano Prodi's government is trying to approve a budget bill that aims to cut the deficit to 2.8 percent next year, below the EU's 3 percent ceiling for the first time since 2002.

The OECD faulted Prodi's budget for relying too much on increased revenue rather than spending cuts to tame the deficit, a criticism which led to the downgrade of Italy's creditworthiness by Standard & Poor's and Fitch Rating's last month. The budget includes 35.4 billion euros ($46.5 billion) in spending cuts and revenue-raising measures; a third of that amount will come from fighting tax evasion.

``In Italy, the fiscal adjustment is entirely due to higher taxes, with no serious attempt to cut spending,'' the OECD said in the report.

This last part is indeed a damning indictment.

We also need to take into account downside risk on the growth forecast, if the actual environment next year turns out to be harsger than many are imagining at present:

Growth in Italy's economy will slow next year to 1.4 percent from 1.8 percent this year, the OECD said. Europe's fourth-biggest economy will grow at around 2 percent this year, the fastest pace since 2000, Finance Minister Tommaso Padoa- Schioppa said yesterday.

Italy will fail to bring its budget deficit below the European Union ceiling for the fifth consecutive year in 2007, the Organization for Economic Cooperation and Development said.

Italy's deficit will reach 3.2 percent next year, the Paris-based organization said in its twice-yearly forecast. Prime Minister Romano Prodi's government is trying to approve a budget bill that aims to cut the deficit to 2.8 percent next year, below the EU's 3 percent ceiling for the first time since 2002.

The OECD faulted Prodi's budget for relying too much on increased revenue rather than spending cuts to tame the deficit, a criticism which led to the downgrade of Italy's creditworthiness by Standard & Poor's and Fitch Rating's last month. The budget includes 35.4 billion euros ($46.5 billion) in spending cuts and revenue-raising measures; a third of that amount will come from fighting tax evasion.

``In Italy, the fiscal adjustment is entirely due to higher taxes, with no serious attempt to cut spending,'' the OECD said in the report.

This last part is indeed a damning indictment.

We also need to take into account downside risk on the growth forecast, if the actual environment next year turns out to be harsger than many are imagining at present:

Growth in Italy's economy will slow next year to 1.4 percent from 1.8 percent this year, the OECD said. Europe's fourth-biggest economy will grow at around 2 percent this year, the fastest pace since 2000, Finance Minister Tommaso Padoa- Schioppa said yesterday.

Thursday, November 23, 2006

The Future of Young People In Italy

Following up on my earlier post about the problem of graduate out-migration from Italy, Roberto has drawn this Time magazine article to my attention. I really like the photo since somehow it draws attention to that combination of the old and the new which, if people only could find the way to work with it, could serve as a basis for moving things forward in Italy. A nice crisp winter's morning, just like we have in Barcelona today.

Growing up, Italian teenagers learn the tale of Giotto and the fly. As a young apprentice in 13th century Florence, the aspiring painter sketched a fly on the nose of a portrait his master-teacher Cimabue was finishing. So lifelike was the insect that when the elder painter returned to the studio, he repeatedly tried to swat it off the canvas. Realizing he'd been fooled by the bravura talent of his pupil, Cimabue told him: "You have surpassed your teacher." Thus encouraged by his master, Giotto went on to revolutionize Western painting, and posterity regards him as the man who launched the Italian Renaissance.

Fast-forward to Italy 2006, and the image of the precocious apprentice has been replaced by a humbler figure: the underemployed 30-something despondent about the present, let alone the future. Today's Italy is defined by stories like that of Vincenza Lasala. At 32, four years after graduating with honors in mechanical engineering, she is living with her parents in the same house where she grew up. She has sent more than 200 résumés to large corporations and small companies around the country, but all she has managed to secure are a handful of part-time stints, unpaid internships and training programs. From her home in the sleepy southern town of Avellino, near Naples, a frustrated Lasala speaks for much of Italy's younger generation: "Without a job, my parents are basically still in charge of my life. After all my studying, I don't see the fruits of my effort. Right now, I can't even envision my future."

Business Confidence Drops

Italian business confidence declined in November, hardly dramatically - to 96.8 from 97.1 in October - but the outlook for the Italian economy over the next three months fell to minus 9, the lowest in at least nine months. My feeling is that people have been much too focused on this years good results and have not given sufficient attention to the situation moving forward which will be all important in determining how successful the Prodi government is in addressing the government deficit problem.

Italian business confidence fell in November on concern that a global economic slowdown would hurt exports and crimp growth in Europe's fourth-largest economy.

The Isae Institute's confidence index fell to 96.8 from 97.1 in October, the state-funded research center said today in Rome. The reading matched the median forecast of 24 economists surveyed by Bloomberg News.

``The slowdown in the U.S. is a concern, given that there's no balance in the Italian economy,'' said Robert Perry, an economist at 4Cast Ltd. in London. ``As foreign demand fades, the question is, are there sufficient domestic drivers to keep it going?''

The U.S. economy, the world's largest, expanded at the slowest annual pace in more than three years in the third quarter, weighing on European exports. France's economy stalled in the third quarter and Germany grew less than economists' forecasts, threatening to crimp growth in Italy, which has lagged behind the euro-zone for a decade.

``Expectations fell this month for production levels, but also for the prospects for the Italian economic situation,'' Isae said in today's report. An index measuring the outlook for the Italian economy over the next three months fell to minus 9, the lowest in at least nine months.

Italian business confidence fell in November on concern that a global economic slowdown would hurt exports and crimp growth in Europe's fourth-largest economy.

The Isae Institute's confidence index fell to 96.8 from 97.1 in October, the state-funded research center said today in Rome. The reading matched the median forecast of 24 economists surveyed by Bloomberg News.

``The slowdown in the U.S. is a concern, given that there's no balance in the Italian economy,'' said Robert Perry, an economist at 4Cast Ltd. in London. ``As foreign demand fades, the question is, are there sufficient domestic drivers to keep it going?''

The U.S. economy, the world's largest, expanded at the slowest annual pace in more than three years in the third quarter, weighing on European exports. France's economy stalled in the third quarter and Germany grew less than economists' forecasts, threatening to crimp growth in Italy, which has lagged behind the euro-zone for a decade.

``Expectations fell this month for production levels, but also for the prospects for the Italian economic situation,'' Isae said in today's report. An index measuring the outlook for the Italian economy over the next three months fell to minus 9, the lowest in at least nine months.

Wednesday, November 22, 2006

Consumer Confidence Index Rises in November

Italian consumer confidence rose in November. As can be seen from previous posts (and this one) the index is bobbing up and down, but it is still below the September high.